What is it about?

The new Central Bank of Nigeria (CBN) Registration of Security Interest Regulations 2015 controversially states that is will not regulate transactions between companies and financial institutions if the transaction is by way of an equitable charge. This is because an equitable charge is not recognised as a security device under this new law. I have argued in this article that it is irrelevant whether this law recognises the equitable charge as a type of security, but what is relevant is that all types of security interests whether granted by a company or individual should be subject to a single registration process to promote transparency and predictability.

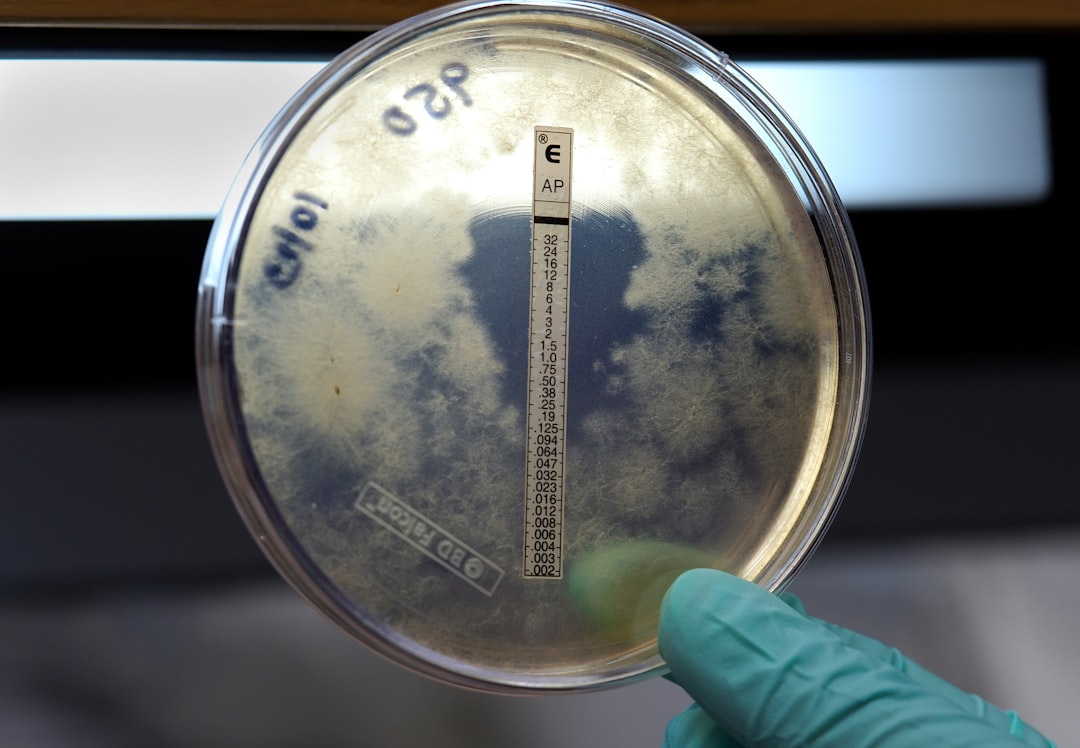

Featured Image

Why is it important?

My article is important because it explains the near-inseparable relationship between the equitable charge and secured transactions, and why both regimes should be interrelated and not completely separated. Research has shown that where security interest laws are harmonised under one single legal framework and/or registration system, low-cost credit becomes accessible to businesses, which often leads to sustainable economic development. Businesses in transition economies, for example Nigeria, would benefit immensely if their laws are reformed along this line.

Read the Original

This page is a summary of: Reforming the law of secured transactions: bridging the gap between the company charge and CBN Regulations security interests, Journal of Corporate Law Studies, August 2016, Taylor & Francis,

DOI: 10.1080/14735970.2016.1214227.

You can read the full text:

Contributors

The following have contributed to this page