What is it about?

The long-run abnormal returns following both stock repurchases and seasoned equity offerings disappear for the events in the most recent decade. The disappearance is associated with the changing market environment – increased institutional investment, decreased trading costs, improved liquidity, and enhanced regulations on corporate governance and information disclosure. In response to the changing market environment, firms become less opportunistic in stock repurchases and offerings.

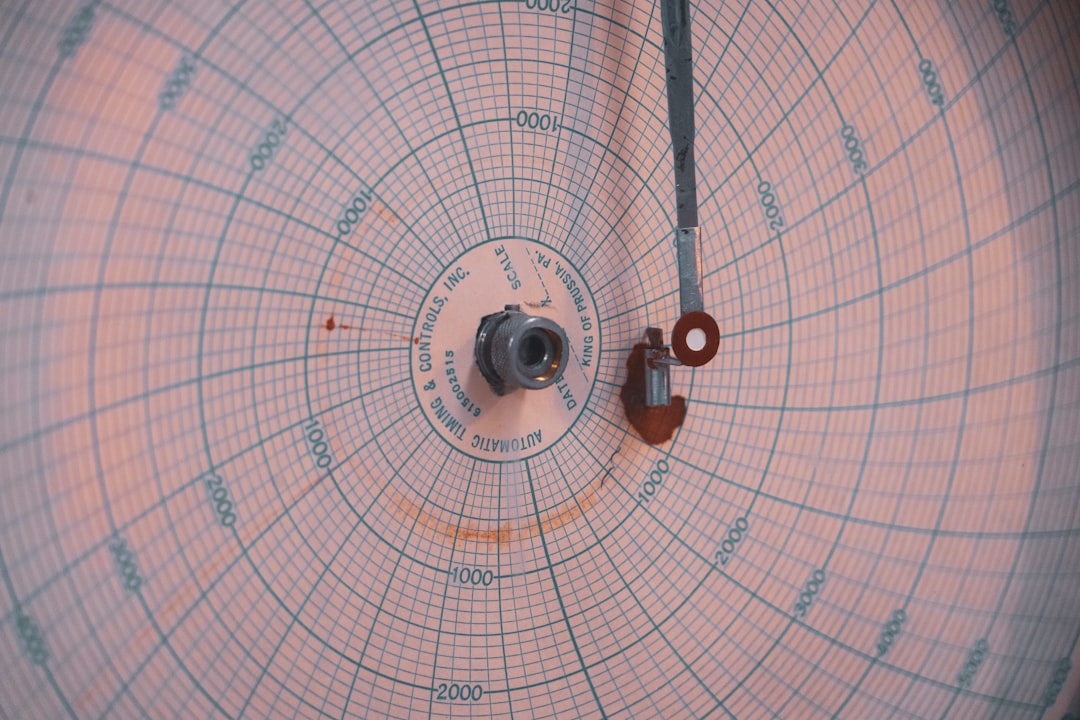

Featured Image

Why is it important?

Our evidence on the recent events contrasts with the findings of earlier studies and sheds light on how the changing market environment affect both asset pricing and corporate behavior.

Read the Original

This page is a summary of: The Persistence of Long-Run Abnormal Returns Following Stock Repurchases and Offerings, Management Science, April 2016, INFORMS,

DOI: 10.1287/mnsc.2015.2150.

You can read the full text:

Contributors

The following have contributed to this page