What is it about?

In the nineteenth century, Karl Marx wondered how it was possible for the exchange of commodities to generate so much wealth for some and so much misery for the others. A similar question now haunts our discussions of financial markets: how can the expanding trade in financial securities create such extraordinary wealth for the financiers while creating increasing vulnerability for the rest of us? Taking a leaf out of Marx’s playbook, I propose in this essay to follow Moneybags to the market and consider what he finds there. In the nineteenth century, Moneybags was able to purchase labor-power at its value while somehow generating more value merely from using it; by the late twentieth century, it appears that Moneybags is similarly able, in all good conscience, to acquire other people’s probability—their ability, that is, to make promises and to be believed—while somehow becoming more credible in the process.

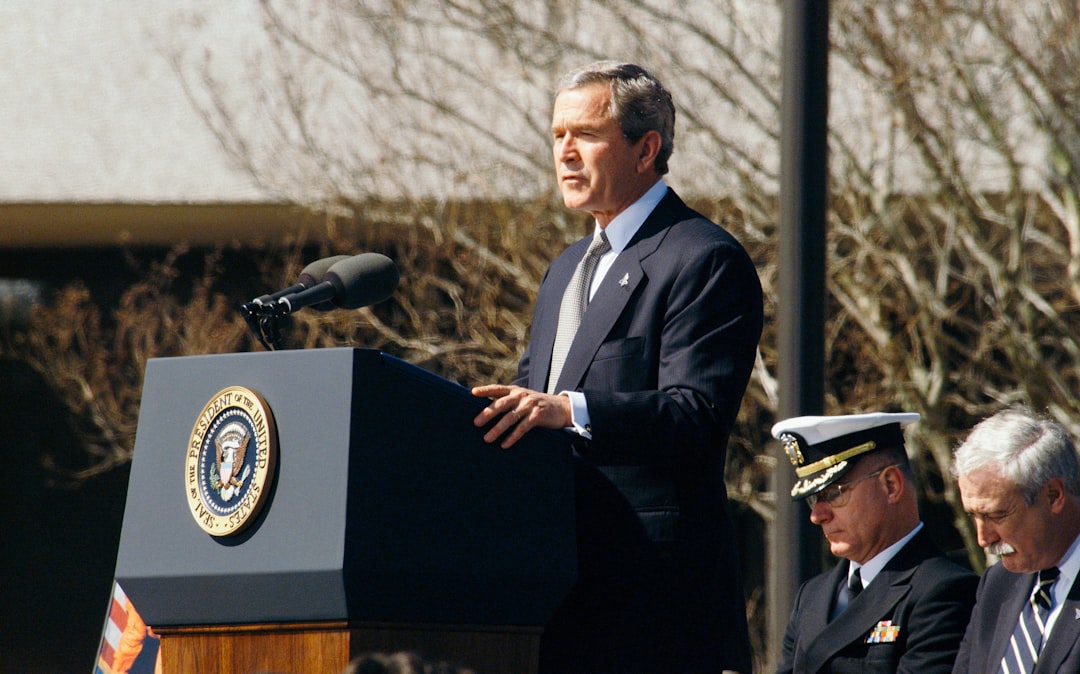

Featured Image

Read the Original

This page is a summary of: “Moneybags Must Be So Lucky”, Political Theory, November 2015, SAGE Publications,

DOI: 10.1177/0090591715613387.

You can read the full text:

Resources

Contributors

The following have contributed to this page