What is it about?

This paper is about why income inequality has increased over the last 40 years. The hypothesis is that labor has seen its bargaining power decrease as offshore production has increased, unionization rates have fallen, and top marginal tax rates have fallen. It tests these hypotheses looking at historical U.S. data and finds that all of these affect each other and appear to help explain why growth for those not at the top have experienced very little income growth over the last 40 years.

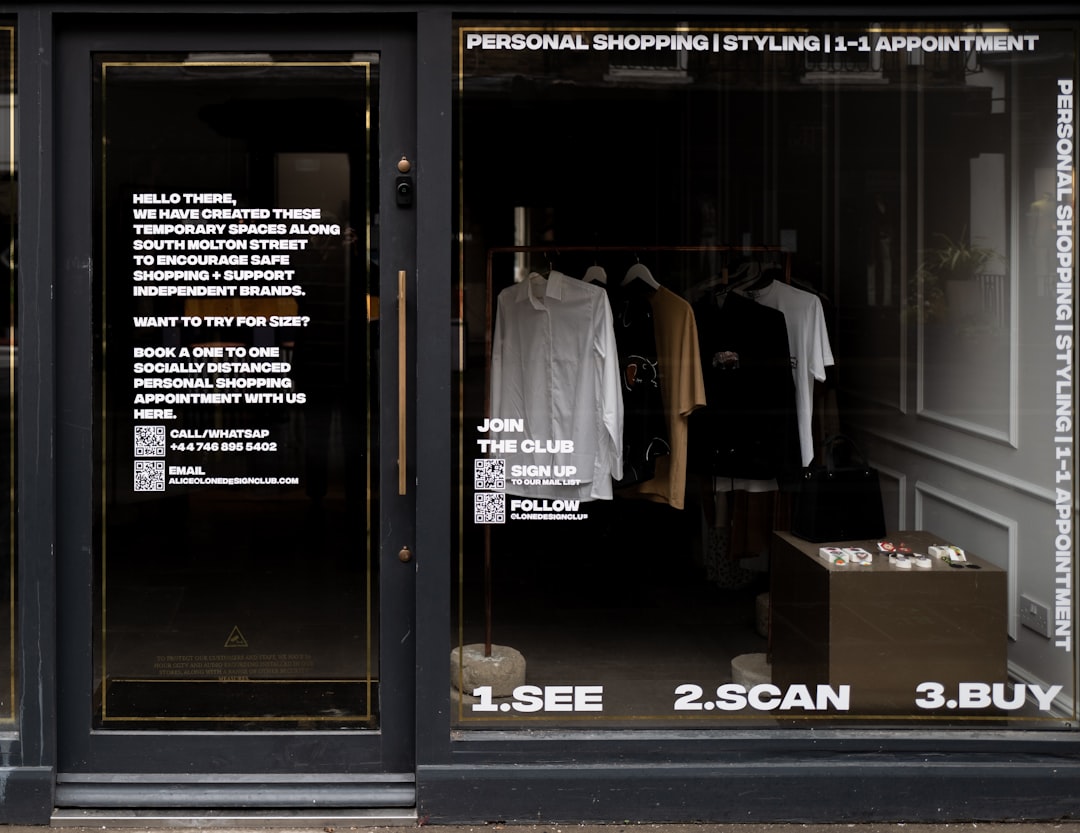

Featured Image

Why is it important?

This paper adds to the literature that identifies changes in bargaining power between workers and executives/firms as the primary cause in the increase in income inequality over the last forty years. This explanation sits in contrast to something like skill-biased technological change which may help explain the increasing spread between the 80th and 20th percentiles, but not the increase in income share going to the top 1% (or even top 0.01%). It suggests that policies designed to increase labor's bargaining power may be more successful in reducing income inequality, especially increasing tax rates for those at the very top of the income distribution.

Read the Original

This page is a summary of: Do Lower Top Marginal Tax Rates Slow the Income Growth of Workers?, Labour, December 2015, Wiley,

DOI: 10.1111/labr.12073.

You can read the full text:

Contributors

The following have contributed to this page