What is it about?

This paper examines theoretically and empirically the extent to which the decisions by foreign firms to invest in a group of countries are influenced by economic factors, as opposed to political risk and institutional factors. Their relevance varies in time and in space (i.e. among countries). A link to an earlier version of the paper: http://ies.fsv.cuni.cz/sci/publication/show/id/4656/lang/en Free access: https://www.researchgate.net/publication/259556763_Political_Risk_Institutions_and_Foreign_Direct_Investment_How_Do_They_Relate_in_Various_European_Countries

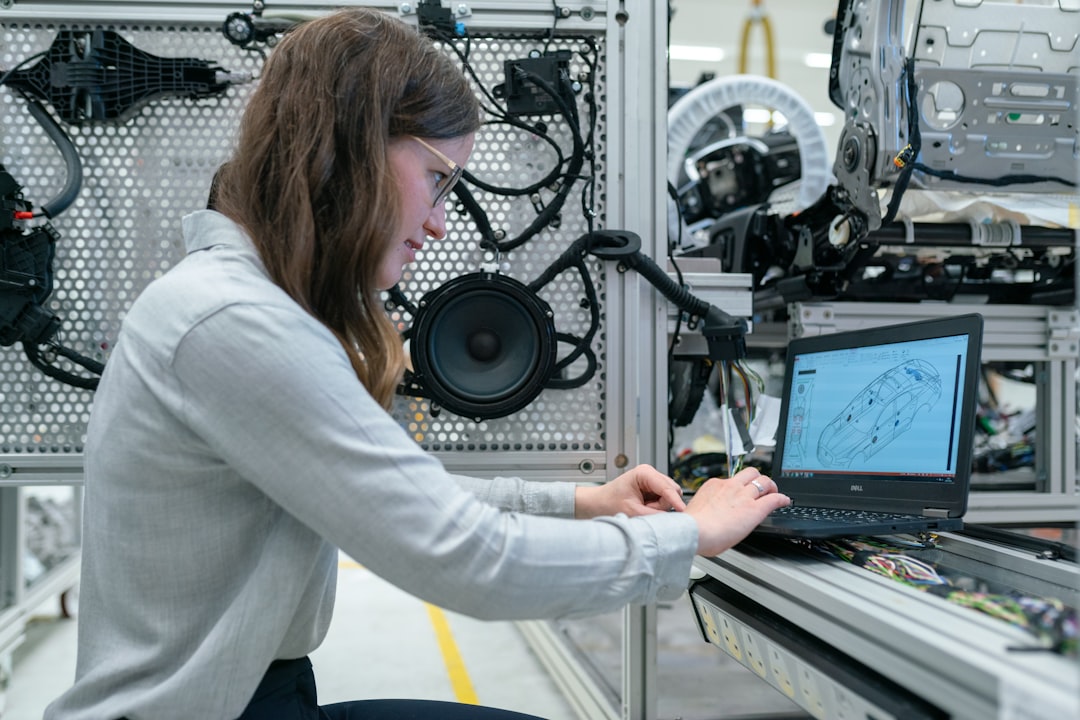

Featured Image

Photo by Mathieu Stern on Unsplash

Why is it important?

Our results suggest that policies and institutions, which differ widely between the 35 tested countries, when assessed quantitatively from both static and dynamic perspectives, significantly influence the behavior of investors in their dual decisions about where to invest and how much to invest. Clustering countries into three groups according to levels of economic maturity revealed that the role of “soft” political factors in FDI decisions is country-specific, often attenuating in time and it is also less predictable than the role of “hard” economic factors.

Perspectives

The paper stresses that any econometric regressions based on panel data should explicitly differentiate between the static and dynamic hypotheses in the model, which leads directly to the differentiation between the behavior explained by cross-sections and the behavior explained by time-series.

Vladimir Benacek

vladimir.benacek@fsv.cuni.cz

Read the Original

This page is a summary of: Political Risk, Institutions and Foreign Direct Investment: How Do They Relate in Various European Countries?, World Economy, September 2013, Wiley,

DOI: 10.1111/twec.12112.

You can read the full text:

Contributors

The following have contributed to this page