What is it about?

Value relevance which is the relation between share prices and financial statements is a well-researched area and this is one of the studies undertaken in a quasi-natural experimental setting in an under researched area in Africa. We use a method of “difference in difference” to show that accounting information based on converged IFRS improves information quality of financial reports contrary to the believe that was not the case given the imperfect markets with few regulations, weak enforcement and limited sources of information in East Africa.

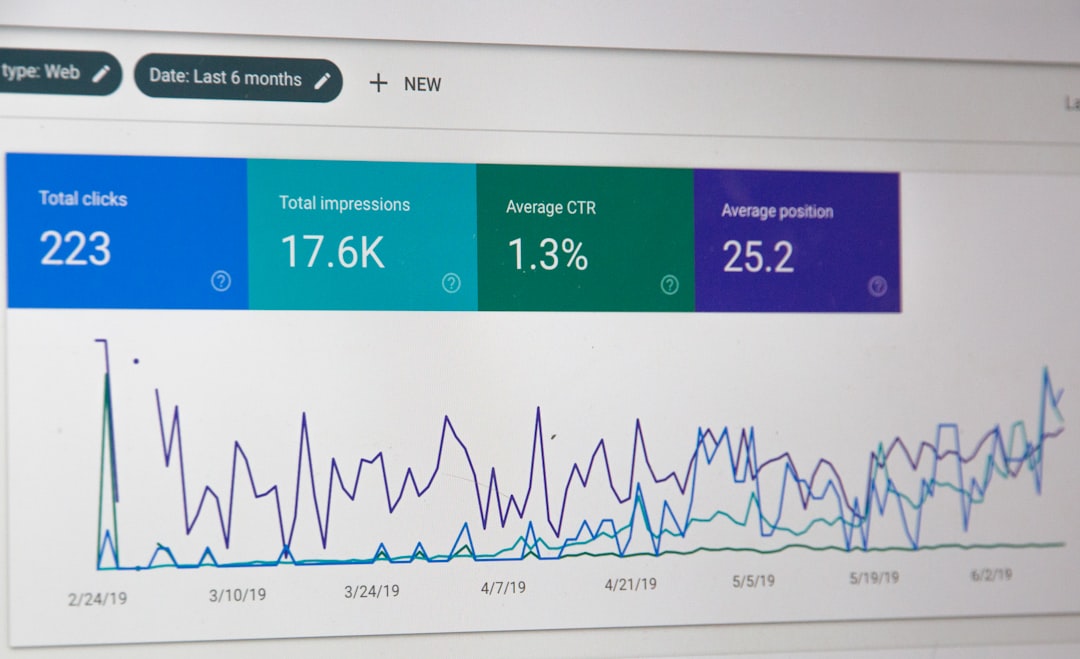

Featured Image

Why is it important?

The study extends the debate on whether value relevance is relevant in emerging markets, which are regarded as imperfect markets with few regulations, weak enforcement and limited sources of information. The findings therefore confirm the importance of applying IFRS in preparing financing statements and encourage countries to enforce their application.

Read the Original

This page is a summary of: IFRS convergence and revisions: value relevance of accounting information from East Africa, Journal of Accounting in Emerging Economies, August 2017, Emerald,

DOI: 10.1108/jaee-11-2014-0062.

You can read the full text:

Contributors

The following have contributed to this page