What is it about?

Why are Caribbean countries able to have independent monetary policy, open capital accounts and exchange rate targeting? This paper argues that commercial banks determine the process by marking up interest rate above the benchmark. This process takes place in the primary markets, thus allowing the central bank to target interest rate using excess liquidity.

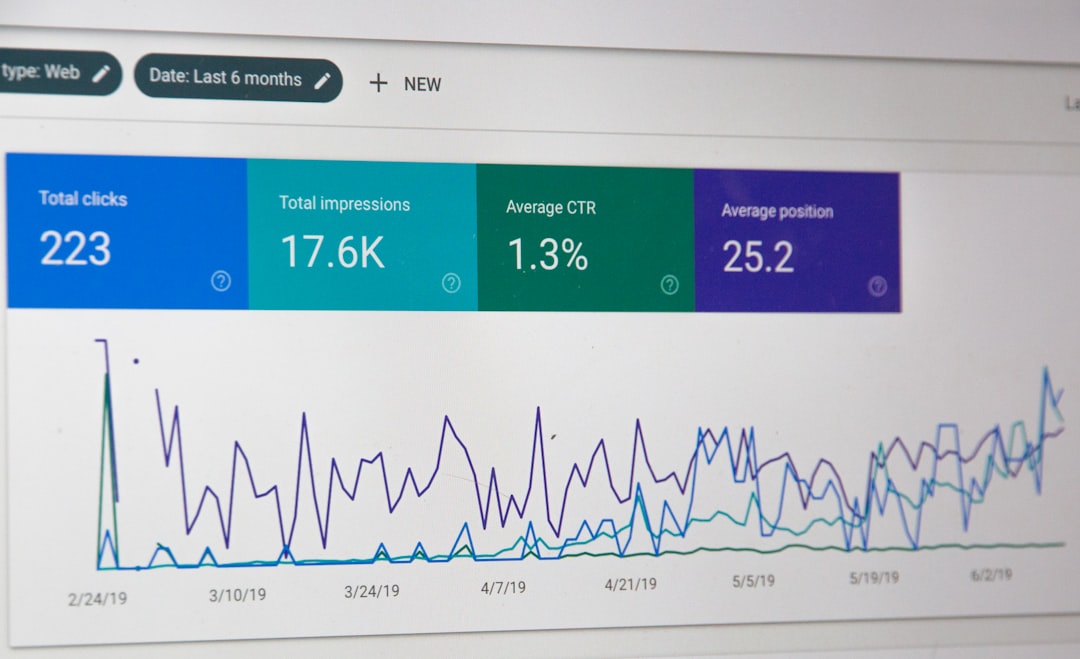

Featured Image

Read the Original

This page is a summary of: Dual nominal anchors in the Caribbean, Journal of Economic Studies, August 2012, Emerald,

DOI: 10.1108/01443581211255639.

You can read the full text:

Contributors

The following have contributed to this page