What is it about?

The paper explores the prudent management of derivatives in pension funds and general asset portfolios to improve portfolio efficiency both in terms of implementing investment strategies and in broadening the range of investment opportunities for building an efficient investment portfolio from a risk-based perspective.

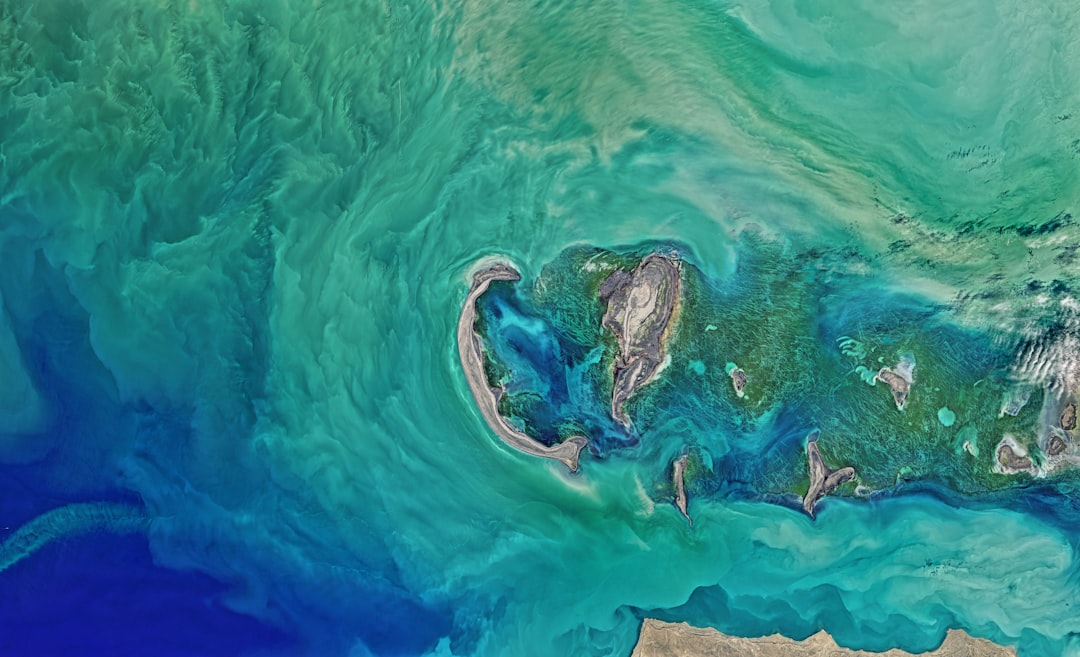

Featured Image

Why is it important?

Just as diversification across conventional asset classes has decreased there has been greater attention paid to the broader array of potential investment strategies that can be accessed via derivatives. The paper explains how a portfolio of both physical and derivative investments can be effectively managed and controlled and also the range of risk techniques that need to be considered.

Perspectives

I wrote this article on the back of a working party group within the actuarial profession. In addition, having worked for a company that build a highly diverse multi-asset portfolio, I believed it made good sense to share the general principles of what was (at time of writing) a unique approach to managing large scale monies for pension funds and foundations.

Malcolm Jones

Standard Life plc

Read the Original

This page is a summary of: Seeking diversification through efficient portfolio construction using cash-based and derivative instruments, British Actuarial Journal, August 2013, Cambridge University Press,

DOI: 10.1017/s1357321713000366.

You can read the full text:

Contributors

The following have contributed to this page