What is it about?

The goodwill impairment test under IFRS requires the manager to make unverifiable estimates and judgments. There are concerns about whether the manager uses these estimates and judgments opportunistically. Using Australian data, we document that firms with stronger governance are more likely to report an impairment loss on goodwill when there are indicators of its impairment than other firms. We, however, find that CEOs tend to report higher goodwill impairment loss in the the first year of their tenure regardless of the strength of the governance.

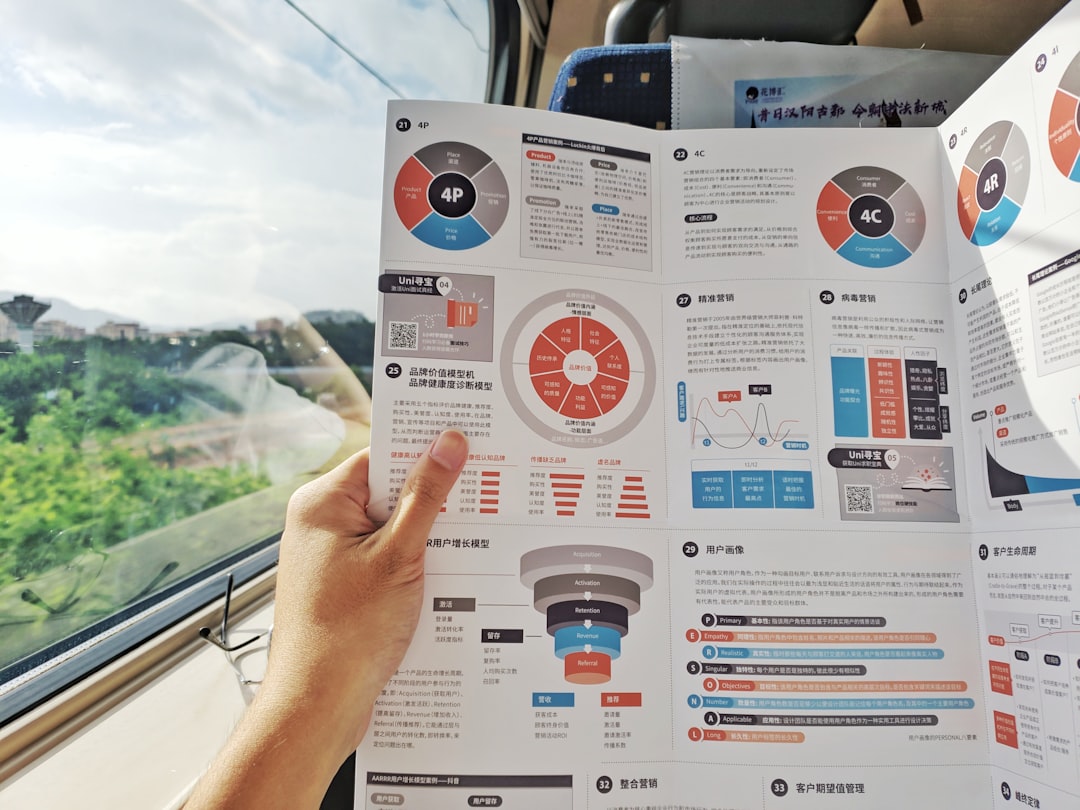

Featured Image

Read the Original

This page is a summary of: The role of corporate governance in accounting discretion under IFRS: Goodwill impairment in Australia, Journal of Contemporary Accounting & Economics, December 2016, Elsevier,

DOI: 10.1016/j.jcae.2016.10.001.

You can read the full text:

Contributors

The following have contributed to this page