What is it about?

Expanding the reach of formal financial services to excluded individuals and businesses is a policy aim in many countries. Research to date has focused on the effect of financial inclusion on the well-being of consumers and overall development and growth. There is much less international evidence on the effect of financial inclusion on financial stability, in particular the banking system, which is the main provider of formal finance. We contend that access to financial services defined too broadly is an imprecise measure for evaluating the influence of inclusion on financial stability. We hypothesize that inclusion through access to payments and savings accounts has a neutral or positive effect on financial stability, while access to credit can weaken financial stability if credit growth occurs without due regard to borrower ability-to-repay. Using comparable cross-country data available since 2011 surveying the demand for different financial services, we find support for adverse effects on bank soundness from credit inclusion only. We also contribute new evidence on the role of the bank market structure in affecting risk-taking incentives by banks. We find that a more competitive structure intensifies the adverse impact of credit inclusion on stability.

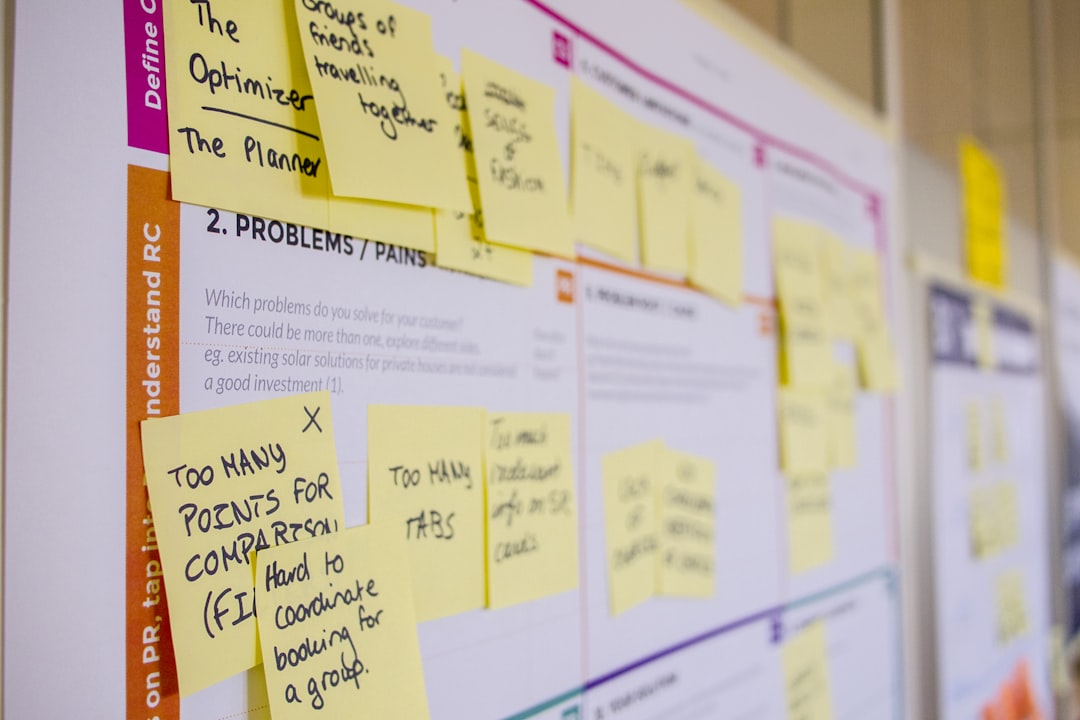

Featured Image

Photo by Verne Ho on Unsplash

Read the Original

This page is a summary of: Financial inclusion, bank market structure, and financial stability: International evidence, The Quarterly Review of Economics and Finance, May 2021, Elsevier,

DOI: 10.1016/j.qref.2021.01.007.

You can read the full text:

Contributors

The following have contributed to this page