What is it about?

China’s socio-political institutions create state-owned corporate empires with unique agency conflicts when increased state ownership drives higher management expenses and lower firm profitability though empire building. Long-term debt is used to finance empire building, while foreign capital investments and innovativeness can mitigate these agency conflicts.

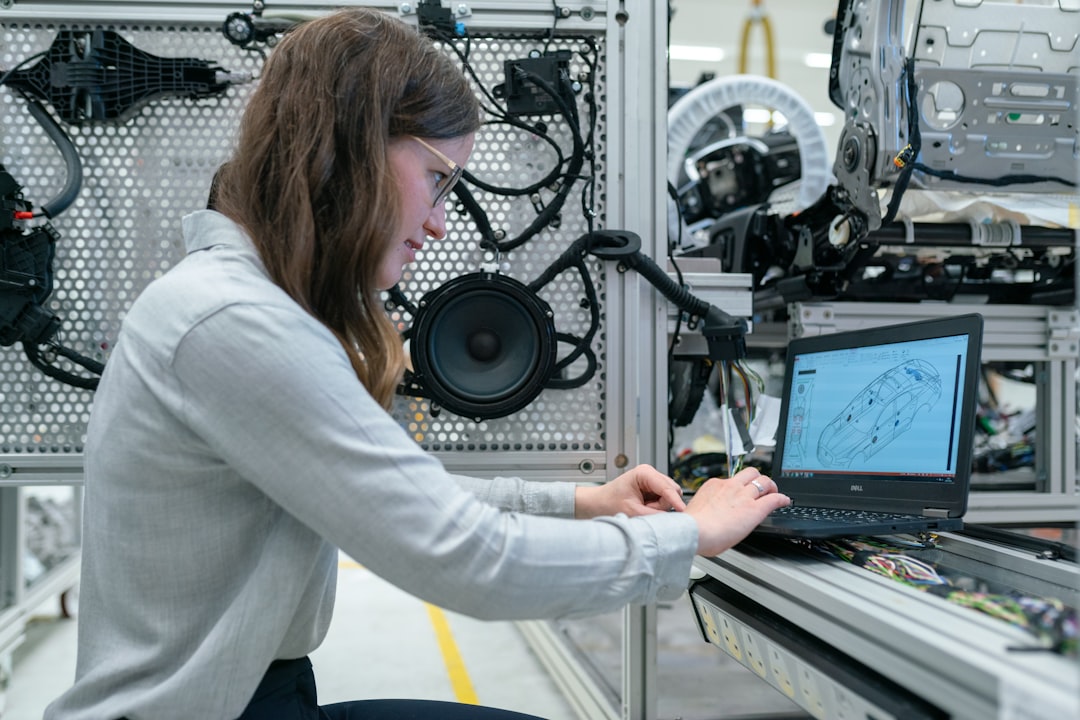

Featured Image

Photo by Kit Suman on Unsplash

Why is it important?

How empire building mediates the relationship between state ownership and performance in China?

Perspectives

Integrating agency and institutional perspectives, we describe how China’s socio-political institutions create state-owned corporate empires with unique agency conflicts. We develop a framework demonstrating how economically unjustified firm expansion, i.e. empire building, mediates the relationship between state ownership and performance. We uncover the instrument in empire building and appropriate corporate governance and strategic management remedies. An empirical study on 29,638 Chinese firms evidences that (1) increased state ownership drives higher management expenses and lower firm profitability though empire building; (2) long-term debt is used to finance empire building; and (3) foreign capital investments and innovativeness can mitigate these agency conflicts.

Jianjun Zhu

New Mexico State University

Read the Original

This page is a summary of: Unfolding China’s state-owned corporate empires and mitigating agency hazards: Effects of foreign investments and innovativeness, Journal of World Business, April 2019, Elsevier,

DOI: 10.1016/j.jwb.2019.02.001.

You can read the full text:

Resources

Contributors

The following have contributed to this page